Sales tax refers to the sum of money that is applied by the Government and the company has to pay it for the sale of goods and services. It is a financial obligation to run a business in a specific province and thus paying sales tax is very important. Sometimes when a user tries to generate sales Tax they tend to encounter QuickBooks Sales Tax Error. Albeit, this error can be triggered by various reasons.

Nevertheless, when users start generating the Sales Tax, they may encounter QuickBooks Sales Tax Error. If you receive a notification “An application error has occurred while processing your request.” It means that the software is down with technical glitch problems and must undergo a rectification process. The most common reasons are mentioned below, read further to check out.

Reasons Behind Sales Tax Error

Before learning the troubleshooting process for QuickBooks sales Tax, let’s check out a few most common reasons for the factor error and factors that influence the error. Incorrect settings in the web browser.

- Accumulation of cache data and collection of cookies in the browser

- If the settings of QuickBooks are not properly set up

- If you have deleted crucial information from the records by mistake.

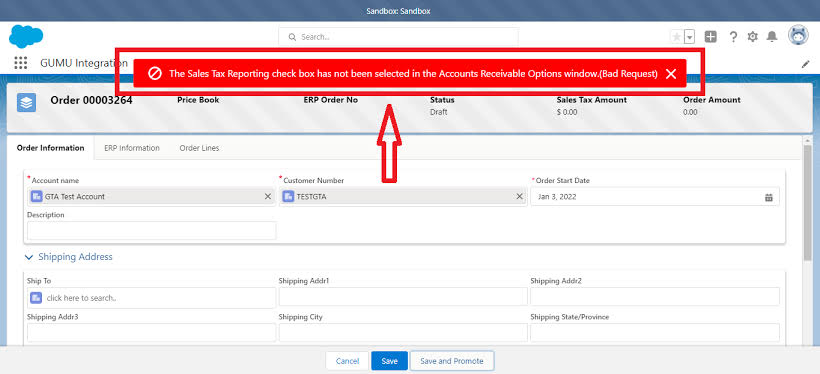

- If the sales tax reporting check box is not selected in the account receivable window.

Troubleshoot processes for QuickBooks sales Tax Errors as per the problems

Various issues can arise due to QuickBooks sales Tax, here are all the solutions along with the set of problems. Identify the problem that your system is undergoing and then read the solutions given underneath.

Problem 1 –“T” will appear on the Invoice, even when the Sales Tax Feature is Disabled

This is one of the most common glitches when the user disables the sales tax feature and the system does not update thus the letter “T” starts showing up in the invoice.

Solution – in this case, the user needs to generate a Duplicate Template for the Invoice. Here are the steps to follow the solutions

- Go to QuickBooks desktop, and hit on the List of menu tab.

- Now you need to pick the correct Templates from the drop-down menu to open it.

- Select the template that you are working with.

- In the next step, you need to hit Duplicate from the drop-down.

- Further, you must move to the Select Template Type section, followed by clicking on Invoice, and finish by clicking on the OK button.

- Now, you must move back to Invoice and launch the duplicate template that you just created

Problem 2 – Negative Sales Tax Payable reflected on the Cash Basis Balance Sheet

The cash basis balance sheet report is made very carefully since it represents the correct business status. Any issue in the balance directly leads to disturbance in the accounts. However, if the sheet displays any negative sales tax payable, it suggests that you are to be paid by a debtor.

Solution – Here are the steps that you need to follow if the sales Tax payable in QuickBooks is incorrect.

- Sign in to the company data file by using your administrator credentials.

- In the next step, you must click on the File tab and choose to “Single-user Mode” option.

- Further, click on the Edit tab and then, choose the preferences from the drop-down menu.

- Choose Sales Tax and then click on the Company Preferences button.

- Make sure that you pick the appropriate basis that suits organizational requirements and finally press OK.

Problem 3 – Issue with Sales Tax when Creating a Credit Memo

If there is any return, refuse, refund or if the customer pays more than the intended amount a credit memo is generated. The purpose of the memo is to create a limit on the money that can be utilised in future. Sometimes while creating a memo, the System tends to face unidentified errors leading to a disabled data file.

Solution – Create the Memo and Disable the Sales Tax.

The errors generally occur when the sales tax is off. For generating a memo it is required to turn it on. Check the following steps to execute the process.

- Go to QuickBooks, click on the Edit tab and then select the preferences from the drop-down menu.

- Further, you need to click on the Sales Tax option, then hit on Company Preferences.

- In the next step go to the ‘Do you charge sales tax?’ section and next to it the Yes radio button that you need begin creating the Credit Memo for the customer.

- Now, go ahead and the Sales Tax by following steps 1 – 3 and clicking on the No radio button.

Common Mistakes Made in Sales Tax

Here is a list of the most important points that you must keep in mind about the common mistakes that users end up making while they are handling sales tax issues. Scroll till the end and make sure you follow the instructions to keep these errors at bay.

- Make sure that you optimise the sales tax collections.

- Understanding and estimating the amount along with the risk of damage that employee theft can cause to the organization.

- Be transparent with the customers and avoid hiding the sales tax information from them.

- Dont miss out on calculating the sales tax for products that are purchased for resale.

- Do not overcharge the customer and pressure them to for paying tax, over transactions that do not fall under the sales tax category.

- Adhere to the profit margin rules of the state where you are running your business in.

Now that you have come across QuickBooks sales Tax Error, its meaning, reasons and troubleshooting methods, it would’ve been easier for you to manually handle the discrepancies that may arise while generating the cash memo. Follow the instructions that are given and if you face any technical hindrance then do not feel hesitant to seek professional help. You can connect with quickbooks enterprise support for any technical assistance 24×7 by calling on our toll-free number or through our official website.